Ansa addresses a growing demand from stakeholders, investors, and company owners for sustainability driven value.

Sustainability is gaining traction

2020 marked the start of the decisive decade, with the effects of climate change particularly visible across the world.

Accelerated awareness and transition towards a carbon-neutral economy will generate unprecedented strategic shifts and unique sources of value creation. Next-generation mobility, new building efficiency, or improved waste and plastics recovery are only a few examples of the drivers that are profoundly reshaping the corporate landscape. European regulations such as the EU Taxonomy, Sustainable Finance Disclosure Regulation (SFDR), or the Non-Financial Reporting Directive foster transparency in ESG performance. New avenues to capitalize on sustainability megatrends and associated opportunities are appearing, prompting organizations to become proactive actors of change.

We are a boutique advisory firm focusing on Sustainability Value.Since its creation in 2017, Ansa has supported private equity funds and major infrastructure players in their transformation journey, as well as players from the consumer products industry.

We are a boutique advisory firm focusing on Sustainability Value.Since its creation in 2017, Ansa has supported private equity funds and major infrastructure players in their transformation journey, as well as players from the consumer products industry.

In Latin, Ansa means close loop, or safe harbour, symbolizing the Circular Economy. It also means opportunity.

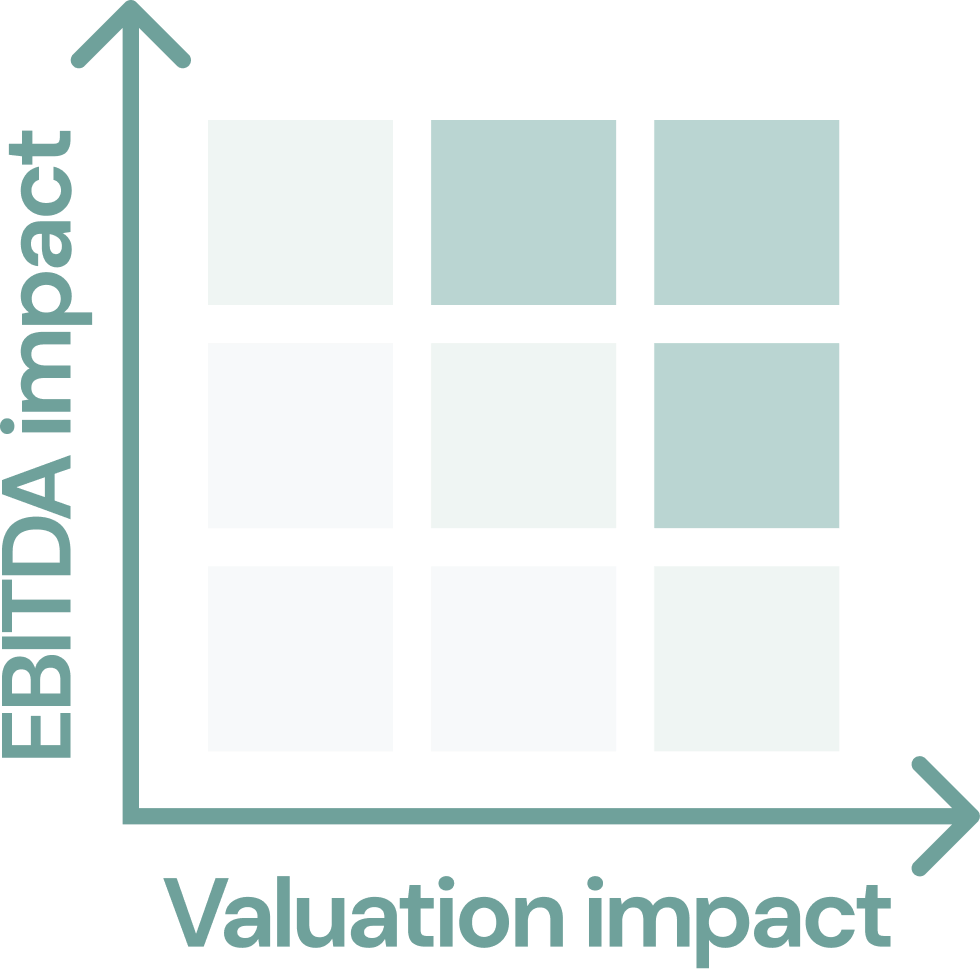

Sustainability is a source of value creation

At Ansa, we believe that strategy is now strongly intertwined with sustainability.

The necessary low carbon transition is a unique opportunity to project your company into a sustainable future.

The leaders of this transition will create long-term value on complementary dimensions.

Improved EBITDA

- Cost savings and resource efficiencies

- Risk management actions

Enhanced value multiples through sustainability related growth strategies

- Changing the composition of the business portfolio

- Being innovative/creating new products and reaching new customers/markets

An opportunity for Investors, companies and funds

Rethinking business models and identifying new business opportunities are now a must to position as a role model in any sector.

Our team is dedicated to helping companies grasp Circular Economy opportunities, optimizing their resources loops and leveraging strategic shifts driven by sustainability megatrends. We favor a long-term relation with our clients up to the delivery of projects and their translation into concrete numbers and financial results.

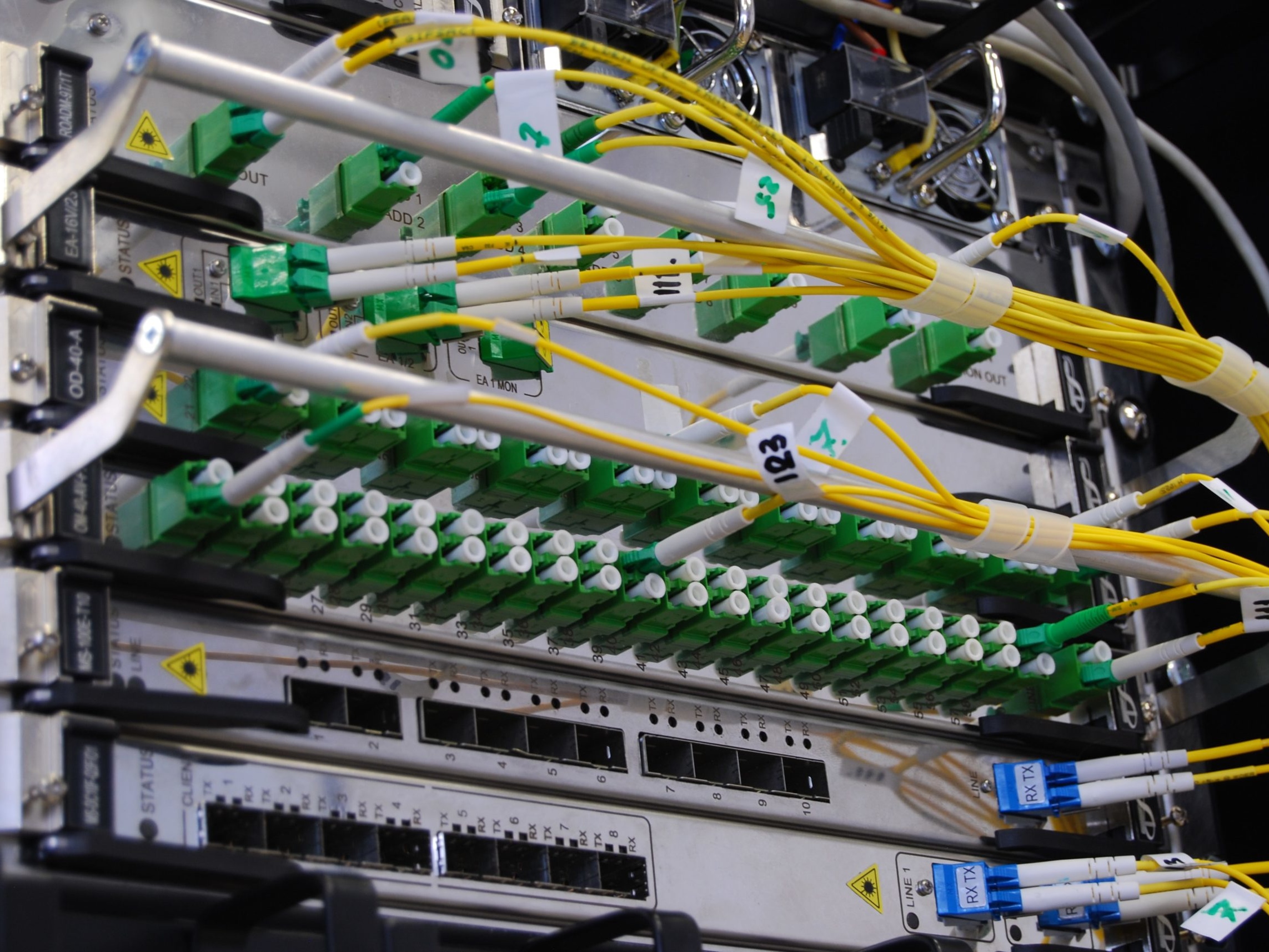

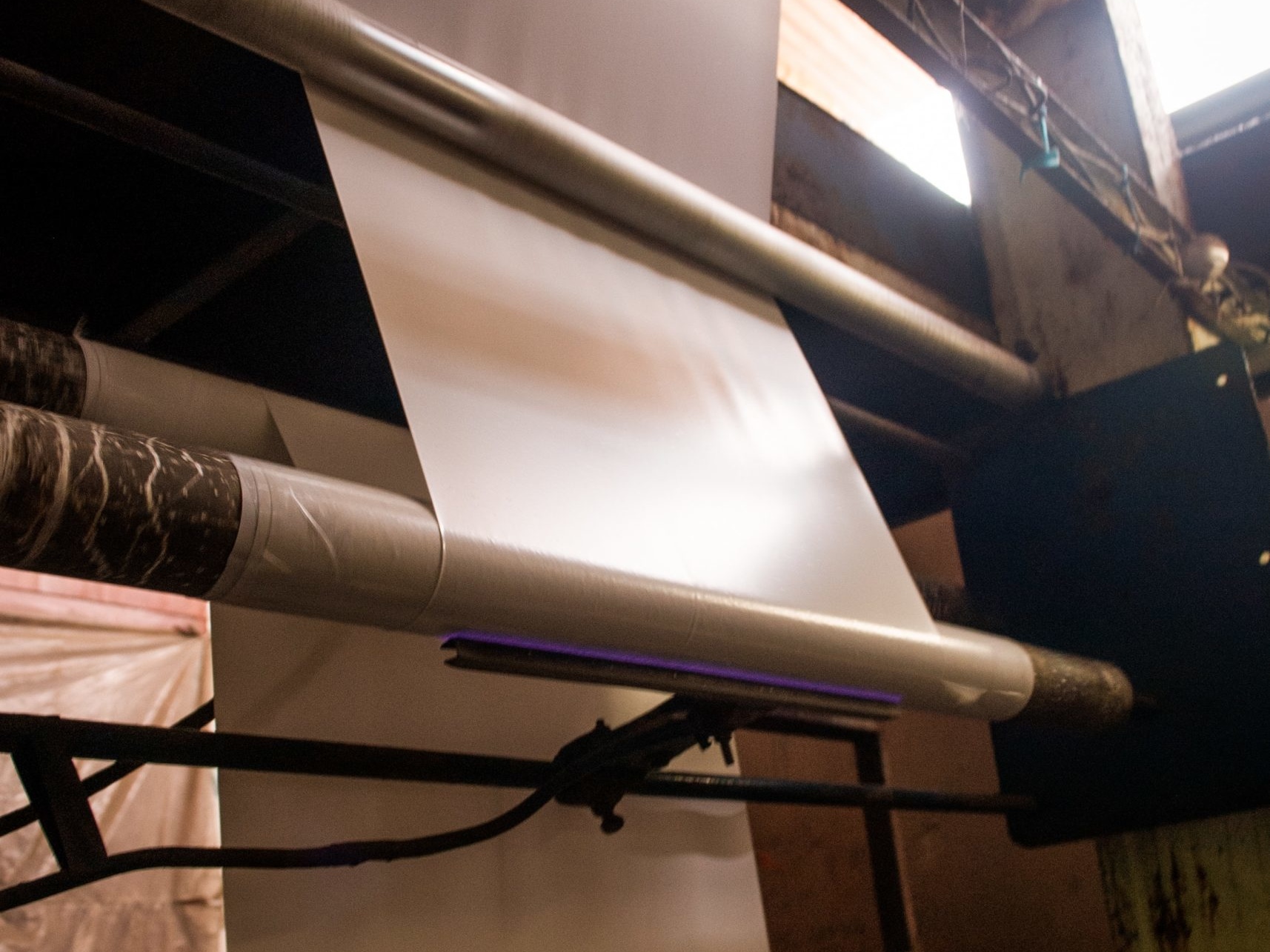

For most assignments, projects include the introduction of novel ideas, technologies, and solutions (e.g., Biofertilizers or asphalt recycling, EPA approved evapotranspiration caps for landfill closure, Sustainable Aviation Fuels).

We leverage our deep understanding of strategy, operational transformation & transactions dynamics to catalyse the sustainability transition of asset managers, portfolio companies, major leaders and SMEs.